How to benefit from the government tax write-off

2020 has been a tough year so far for many farmers across Australia. Bushfires ravaged many parts of the country at the start of the year and now with the COVID-19 pandemic upon us, some farmers are struggling to get ahead.

The Australian government has recognised these struggles and on the 12th of March 2020 a $17.6 billion stimulus package was announced with the aim of keeping Australians in jobs, businesses in business, and households supported. A big part of this stimulus package was the announcement that the instant asset write-off was being increased – great news for farmers!

The instant asset write-off increase won't be sticking around for long though, in fact, you have until the 31st of December 2020 to take advantage of this incentive (originally 30 June 2020). Read on to find out more about what’s on offer and see how you can make the most of this.

Supporting business investment

During times of economic uncertainty, it becomes second nature to start watching our pennies and only spend money on the essentials. To help keep the economy moving forwards in these uncertain times, a stimulus package was announced by the government so that people and businesses alike would continue to spend, and put money back into the economy.

$700 million from the stimulus package has been dedicated solely towards delivering support for business investment and specifically, increasing the instant asset write-off.

The instant asset write-off increase

The instant asset write-off threshold has been increased from $30,000 to $150,000. Access to this has also been expanded to include businesses with an aggregated annual turnover of less than $500 million (up from $50 million). The new instant asset write-off threshold has been extended from the 30th of June to the 31st of December 2020, for new or second‑hand assets first used or installed ready for use in this timeframe.

Eligibility for the instant asset write-off depends on a number of different factors which include:

- Your aggregated turnover.

- The date you purchased the asset and if it was either first used, or installed ready to use.

- The cost of each asset is less than the threshold.

Businesses with a turnover of $500 million or more are not eligible to use the instant asset write-off.

How can farmers benefit from the tax write-off?

Farming businesses rely on machinery and equipment for day-to-day operations so the increase to the instant asset write-off is welcome news! Under the instant asset write-off eligible businesses can:

- Immediately write-off the cost of each asset, as long as the cost is less than the threshold.

- Claim a tax deduction for the business portion of the asset cost, in the year the asset is first used or installed ready for use.

This means that eligible farming businesses can still spend what they need to on new machinery and equipment, without having to worry about cashflow.

See examples of how the instant asset write-off can help your business here.

The increased instant asset write-off threshold is only available until the 31st of December so now’s the time to order the farm equipment that you need! Australian businesses that are looking to upgrade their farm or machinery storage shed should look at starting this process now so that they can take advantage of this incentive.

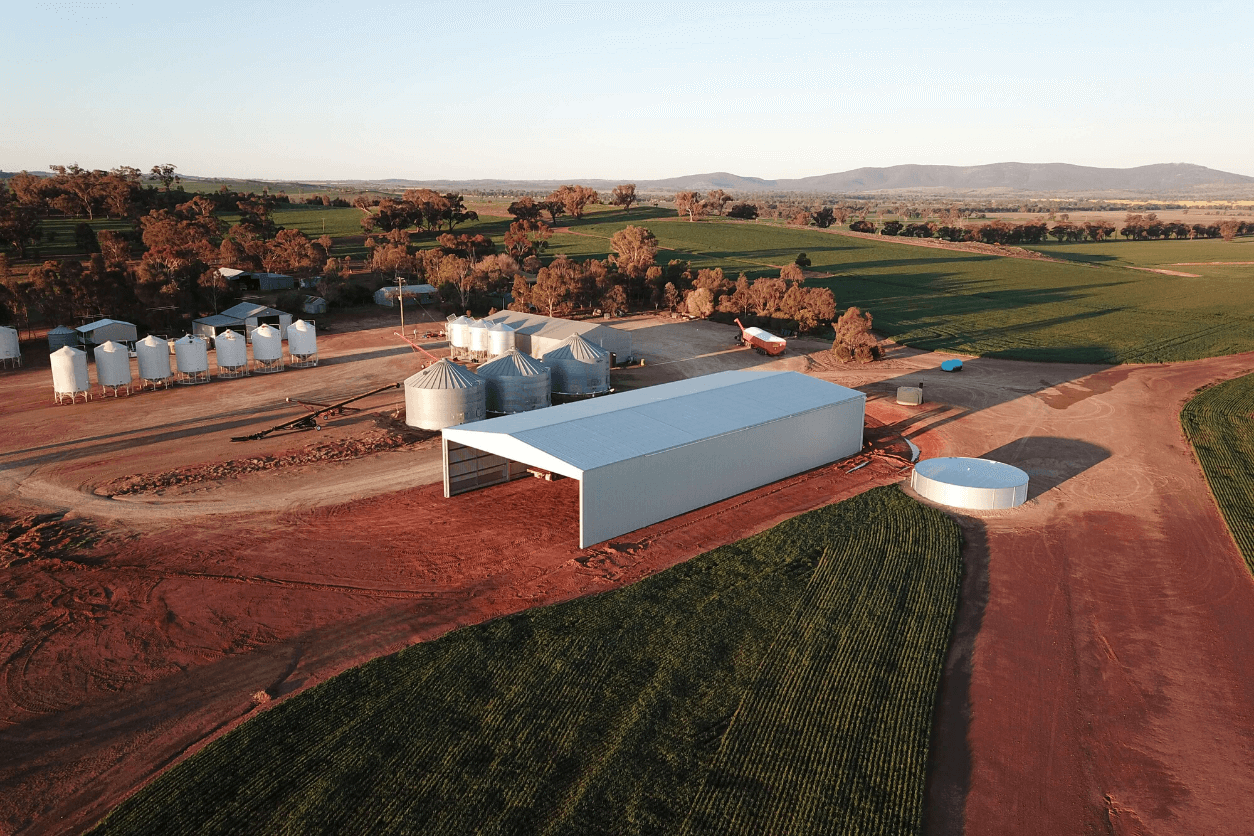

The ABC Sheds range of structural steel sheds are made to stand the test of time and with a 25 year “you’re covered” guarantee, you’ll know that your money is well spent. If you’re looking to use the instant asset write-off for something like a new shed for your farm then we would encourage you to request a quote today, so that you don’t miss the deadline. If you'd like more information on how to make the instant asset write-off work for you, get in touch and we'd be happy to help.

Interested in learning more about our farm sheds? View the ABC Sheds range here.

For up-to-date information on tax relief and various financial assistance options available, please visit our financial assistance page.

-1.png?width=3641&height=660&name=abcshedstransparent2%20(1)-1.png)